Hello friends!

The command Flexibity is excited to share with You my new success. For many professionals whose job involves daily cash register equipment in 2017 stood a fairly serious issue of modernizing its control and cash equipment (KKT) due to the introduction of new requirements of the Federal law № 54. For those of you not familiar with these requirements, link with the explanation.

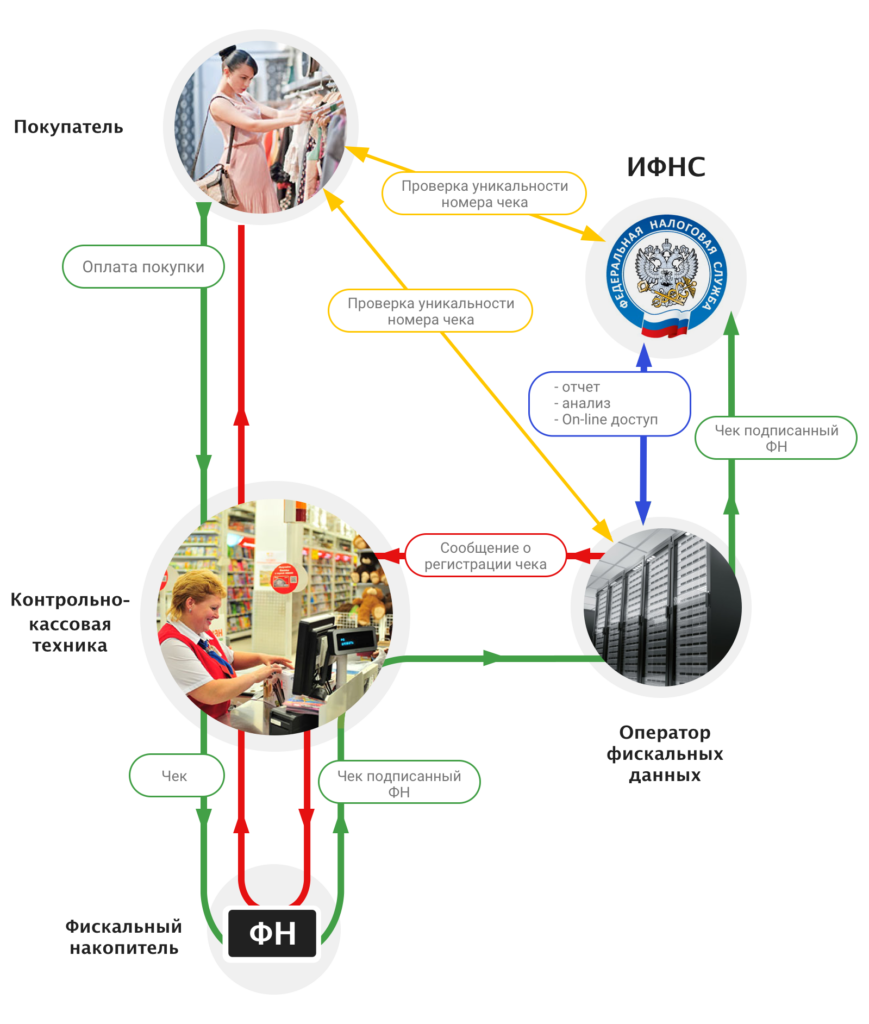

In short, the requirements of the new law envisage the following scheme of transfer of receipts in FNS:

- a Receipt is generated at the cash register, written to the fiscal memory.

- Fiscal drive signs a check individual fiscal basis.

- the Signed check is sent to the Operator’s fiscal data (CRF). The CRF reports KKT signal that the check passed.

- of the CRF stores for this check and required reports to Federal tax service.

As you can guess, in the new conditions of a selection. Will have to update Park of KCP in his shop… or contact the solution team Flexibity implemented the company Neste. We made an upgrade of the existing software installed on the cash equipment, as part of our new project FPROXY. Our software module is installed on a workplace of the cashier of the gas station and provides the adaptation of the interaction between the set the box office cash management program SetOil Neste Edition and module software API Azimuth.dll control and cash equipment (KKT) series Approx manufactured by SCB VT “Iskra”. This follows the current and future requirements of the federal law # 54 (federal law # 290) and workflows of the Customer.

Currently, FPROXY works on dozens of petrol stations of the company Neste.

We will be happy to assist You in resolving the issue of adaptation of the cash equipment under new requirements FZ-54 and see other projects, performed by our friendly team.